|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

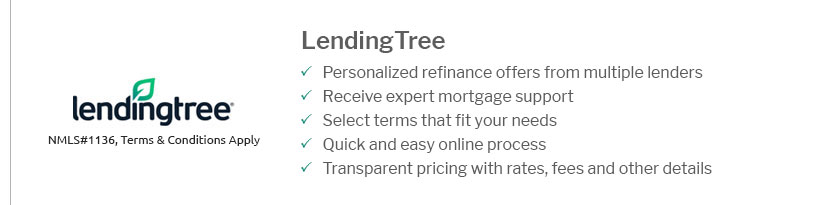

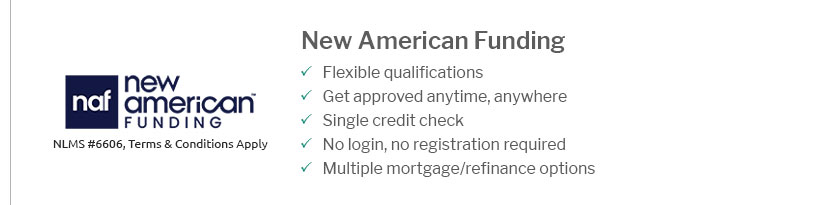

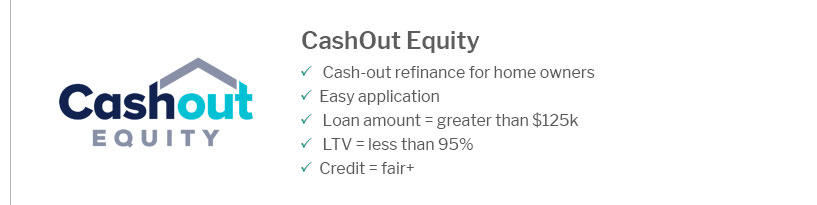

Understanding Non Qualified Mortgage Lenders: A Comprehensive GuideIn the realm of real estate financing, non qualified mortgage lenders have become a pivotal option for borrowers who might not meet the standard requirements for conventional loans. These lenders provide flexible financing solutions for individuals with unique financial situations. What Are Non Qualified Mortgages?Non qualified mortgages (Non-QM) are designed for borrowers who cannot qualify for a traditional mortgage. These loans do not adhere to the strict guidelines set by the Consumer Financial Protection Bureau (CFPB) for qualified mortgages. Characteristics of Non-QM Loans

These features make non-QM loans attractive for self-employed individuals, investors, and those with irregular income. Benefits of Non Qualified Mortgage LendersNon-QM lenders offer several advantages:

For borrowers interested in exploring non-QM options, it is beneficial to compare these with other alternatives such as low down payment mortgage options. How Non Qualified Mortgage Lenders OperateApplication ProcessApplying for a non-QM loan involves a slightly different process:

Lenders may ask for additional documentation to accurately assess the borrower's ability to repay. Interest Rates and TermsInterest rates for non-QM loans are typically higher than conventional loans due to the increased risk. However, many lenders offer competitive terms to attract qualified borrowers. FAQs About Non Qualified Mortgage LendersAs you consider financing options, understanding the nuances of non qualified mortgage lenders will empower you to make informed decisions tailored to your financial needs. https://griffinfunding.com/non-qm-mortgages/

Non-QM loans are an alternative to qualified mortgage (QM) loans. More specifically, a non-QM loan is one that is not required to meet the Consumer Financial ... https://crosscountrymortgage.com/mortgage/loans/non-qm/

Non-QM loans are mortgages that offer their own set of criteria, often including more flexible income and credit requirements. These fall outside traditional ... https://www.scotsmanguide.com/rankings/top-mortgage-lenders/2023-top-non-qm-lenders/

2023 Top Non-QM Lenders ; 9, CrossCountry Mortgage, Cleveland, OH ; 10, Guaranteed Rate, Chicago, IL ; 11, LoanStream Mortgage, Irvine, CA ; 12, First National Bank ...

|

|---|